NEW 2025 Budget Update: See what the Federal Government’s additional tax cuts for 2026/27 mean for you!

Stage 3 Tax Cuts in a snapshot

Stage 3 tax cuts were adjusted from 1 July 2024, aiming to give a bit of a tax break to lower and middle income earners, compared to earlier tax changes that favoured workers already enjoying the biggest salaries.

Compared to the original tax cuts, the new changes help low and middle-income earners by taking less tax from their take home pay. The result: Australians get more money in their pockets each payday.

NOTE: These tax cuts have no effect on your tax return and won’t increase your tax refund!

What was different about the Stage 3 Tax Cuts?

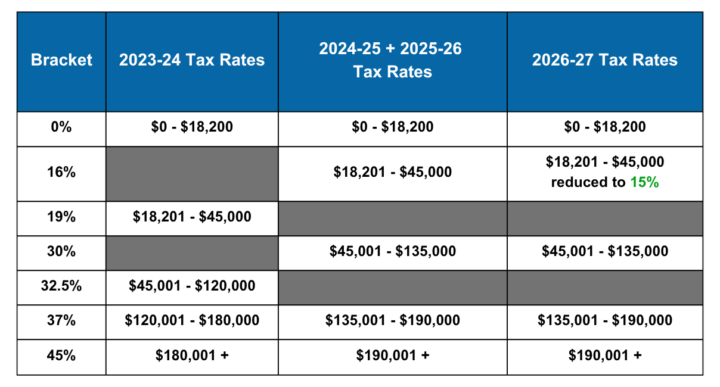

The government’s adjusted tax cuts included changes to income ranges and tax rates in the marginal tax brackets. Australian workers earning between $18,201 and $45,000 a year saw their 19% marginal tax rate reduced to 16%. Starting on 1 July 2026, the rate for the lowest tax bracket will decrease again from 16% to 15%. Additionally, the threshold for the 32.5% tax bracket changed from $120,000 per year to $135,000. The tax rate for these workers also dropped to 30%.

Instead of scrapping the 37% tax bracket, which was in the plan for the original stage 3 tax cuts, the government chose to keep it and changed the threshold to include those earning $135,001 – $190,000.

The highest income earners making over $190,001 continue to sit in the 45% tax bracket. However, they have been receiving the benefits of the lowered tax rates in other tax brackets. This has lowered the tax they pay on some of their income.

Stage 3 Tax Cuts Table

Ready to get your refund?

It takes just a few minutes online, with live online support to help boost your refund.

What are the “Cost of Living Tax Cuts”?

The Stage 3 tax cuts, sometimes referred to as the “cost of living tax cuts”, were changed to provide extra money to more people, not just the highest earners who benefitted from the original cuts.

No matter what we call it, the “cost of living tax cuts” or “stage 3 tax cuts” mostly provide a bit of tax relief to middle and high-income Australians.

Let’s look this in more detail:

How has this affected Australian workers?

Mainly, it has increased the take-home pay for most Australian workers. Here’s how…

According to the Australian Bureau of Statistics, the median weekly salary in Australia was $1,300 a few years ago. During the 2023-24 financial year, tax withheld on this amount was $265.17 leaving $1,034.83 take home pay, after tax. In contrast, under the stage 3 tax cuts, a lower amount of $238.85 tax has been withheld. This has changed the take home pay of someone on the median weekly salary in Australia to $1,061.15, which is $26.32 more per week than the previous year.

Let’s take a look at some more examples:

Retail Worker

Annual Salary: $65,000

Previous Tax: $12,867

Stage 3 Tax: $11,563

Extra weekly take home pay compared to last financial year: $25.07

Extra annual take home pay compared to last financial year: $1,304

Teacher

Annual Salary: $95,000

Previous Tax: $23,242

Stage 3 Tax: $21,188

Extra weekly take home pay compared to last financial year: $39.50

Extra annual take home pay compared to last financial year: $2,054

Doctor

Annual Salary: $156,000

Previous Tax: $45,907

Stage 3 Tax: $42,178

Extra weekly take home pay compared to last financial year: $71.71

Extra annual take home pay compared to last financial year: $3,729

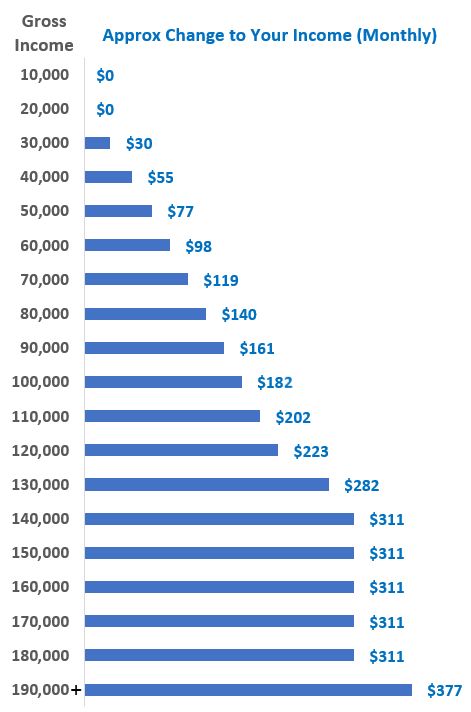

How much better off have YOU been each month?

These tax cuts were revised to take less tax out of Australian workers’ pay, which has somewhat helped with cost-of-living pressures. To help you understand how your pay has been affected each month, we’ve put together the below graph to show an estimate of how much more you should have been receiving in your pay each month, compared to the 2023-24 financial year.

Why were the changes made?

The original tax cuts, announced in 2018, were written before we faced the pandemic, high inflation, several interest rate rises and cost-of-living pressures that have been felt throughout Australia. The current Government designed the changes to give Australians more money in their pocket, while keeping with the original plan to make our tax system fairer for all Australians.

How can the government afford to make these changes?

Compared to the original stage 3 tax cuts, which saw those earning a large salary receive the bulk of the benefits, the new tax cuts provide more relief to lower and middle-income earners, and less benefit to those earning over $135,000 per year. The Federal budget outlines how the government pays for these changes in more detail.

How will the tax cuts affect my next tax return?

You might have noticed that your 2024 tax return was NOT affected by these tax cuts! And the cuts will not affect your tax refund at all in the future. However, as mentioned earlier, the changes should have increased your weekly/monthly take-home pay.

These changes didn’t come into effect until the 2024-25 financial year (from 1 July 2024). Even now, the new tax rate should automatically be applied by your employer every payday, and on your next tax return. This means you should have seen a small increase in your take-home salary from your first pay after 1 July 2024. If not, make sure you ask your employer!

2025 Budget Update for 2026/27 Financial Years

Lowest tax bracket percentage cuts

Starting on 1 July 2026, the rate for the lowest tax bracket will decrease from 16% to 15%. (This means you’ll pay one cent less on every dollar you earn between $18,201 and $45,000.)

Another cut for that same tax bracket starts on 1 July 2027. The new 15% tax rate will drop a further percentage to 14%.

These changes mean a tax saving of $268 for individuals earning $45,000 or more in the 2026-27 financial year. Rising to $536 in the 2027-28 financial year.

Ready to lodge your tax return and get that refund?

It takes just a few minutes online, with live online support to help boost your refund.